How to Create a Financial Plan for Your Business

Creating a financial plan for your business is essential for its success and sustainability. Whether you’re launching a startup or running an established company, having a well-structured financial strategy helps guide your decisions, manage cash flow, and attract potential investors. In this post, we’ll walk you through the basics of how to create a financial plan for your business and ensure its long-term growth.

Why a Financial Plan is Essential

A financial plan is more than just numbers on a spreadsheet; it’s a roadmap that outlines your business’s current financial status and its future goals. It enables you to make informed decisions, forecast expenses, and identify potential risks. With a clear plan, you can confidently navigate challenges, track performance, and ensure that your business remains financially healthy.

Step 1: Understand Your Financial Goals

Start by defining your short-term and long-term financial objectives. Ask yourself:

- How much revenue do you want to generate in the next year?

- What are your startup or expansion costs?

- Are you looking for external funding?

Having clear goals will help you focus on the key elements while creating your financial plan.

Step 2: How to Create a Budget for a New Business

A budget is the foundation of any financial plan. For a new business, creating a budget involves estimating your income and expenses as accurately as possible.

- List Fixed and Variable Costs:

- Fixed costs include rent, salaries, and utilities.

- Variable costs may include raw materials, shipping, and marketing.

- Project Your Revenue:

Estimate your expected sales based on market research and realistic assumptions. - Account for Emergencies:

Allocate a portion of your budget for unexpected expenses to avoid financial strain. - Monitor Regularly:

Regularly review your budget to ensure you’re staying on track and make adjustments as needed.

Using online tools like budget templates or financial planning apps can simplify the process of creating a budget.

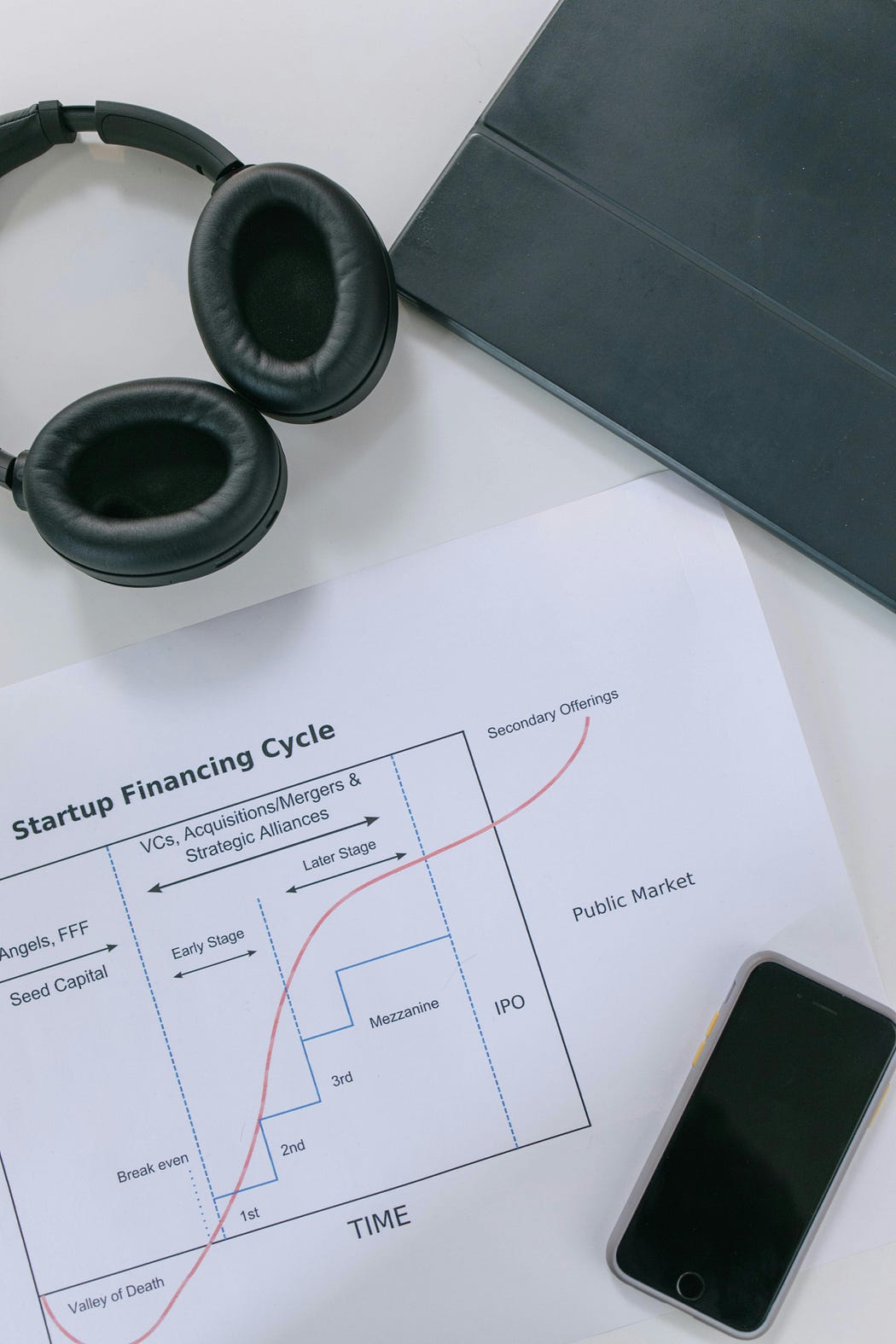

Step 3: How to Create Financial Projections for a Startup

Financial projections help startups plan for the future and demonstrate their potential to investors. Here’s how you can create effective projections:

- Start with Revenue Projections:

Predict your sales growth by analyzing market trends, customer behavior, and industry benchmarks. - Forecast Expenses:

Detail your operating expenses, including salaries, production costs, and marketing efforts. - Estimate Cash Flow:

Cash flow projections track how money flows in and out of your business. Include all inflows (sales, loans, investments) and outflows (bills, salaries, taxes). - Prepare Profit and Loss Statements:

A profit and loss statement showcases your expected profits after deducting expenses from revenues. This is crucial for evaluating your business’s financial health.

Remember, financial projections aren’t set in stone — they should evolve as your business grows.

Step 4: Implement and Review Your Plan

Creating a financial plan is just the beginning. Implementation and regular reviews are essential to ensure it remains effective. Here’s how to do it:

- Set Milestones: Break your financial plan into actionable steps with specific timelines.

- Use Financial Tools: Utilize accounting software or hire a financial advisor to track progress and refine your strategies.

- Analyze and Adapt: Regularly compare your actual performance with your projections and adjust your plan to align with reality.

Conclusion

Knowing how to create a financial plan for your business is a vital skill for any entrepreneur. It provides a clear vision for the future, prepares you for financial challenges, and helps you seize opportunities. Whether you’re learning how to create a budget for a new business or exploring how to create financial projections for a startup, the effort you put into financial planning will pay off in the long run.

With a solid financial plan in place, you’re setting the foundation for your business’s growth and success. Take the first step today, and you’ll be better prepared to achieve your business goals.